Ranges depend on starting stack, asset types, and target markets. See full TCO comparison here

WITH FUSEBOX OS, YOU CAN

Run energy operations as one system

WHY FUSEBOX

Proven in live ancillary markets across Europe

In 30 minutes: map your current stack + target markets and outline the fastest path to first MW live.

Outcomes teams use Fusebox OS to deliver

- Reduce imbalance cost and operational errors with automated, transparent control

- Launch ancillary participation faster across new TSOs without bespoke reintegration

- Scale MW and markets without scaling ops headcount (fewer systems, fewer handoffs)

- Keep ownership and optionality (open OS, no lock-in; swap modules without re-platforming)

Business case snapshot

Trusted by forward-thinking utilities, traders, and asset operators

Used by utilities, traders, and asset operators across PV, Wind, BESS, and flexible loads.

Problem and Solution

From fragmented operations to one system

Modern energy operations run on too many disconnected tools: site controllers, EMS, forecasting models, trading systems, and TSO interfaces, all stitched together with manual processes. This fragmentation increases operational complexity, slows decision-making, and leaves flexibility underutilized.

Fusebox OS replaces this with a single operating system that connects everything end to end, so assets, portfolios, and markets operate as one coordinated system.

Fewer systems. Fewer handoffs. Lower operational load.

Fusebox OS removes the need to manage and maintain parallel tools for control, aggregation, and market participation. Real-time asset control feeds directly into portfolio logic and market workflows, eliminating manual coordination and duplicated processes.

Teams spend less time reconciling data and more time running optimized operations. The result is lower imbalance risk, fewer operational errors, and the ability to scale portfolios without scaling complexity or headcount.

From site to market – automated by default

With Fusebox OS, operations are automated across the full value chain. Hybrid sites respect technical limits by default. Portfolios expose reliable flexibility in real time. Dispatch, bidding, activation, and reporting follow standardized, TSO-compliant workflows.

Market participation becomes a routine operational capability, not a bespoke integration project repeated for every asset type, country, or market.

Built to evolve with your strategy

Fusebox OS is open and modular by design. You can keep your existing tools, integrate new ones, and swap modules without re-platforming or vendor lock-in. As markets, regulations, or strategies change, the system adapts – without rebuilding your stack.

You stay in control of data, decisions, and customer relationships. Fusebox provides the operating system that lets your energy operations evolve at market speed.

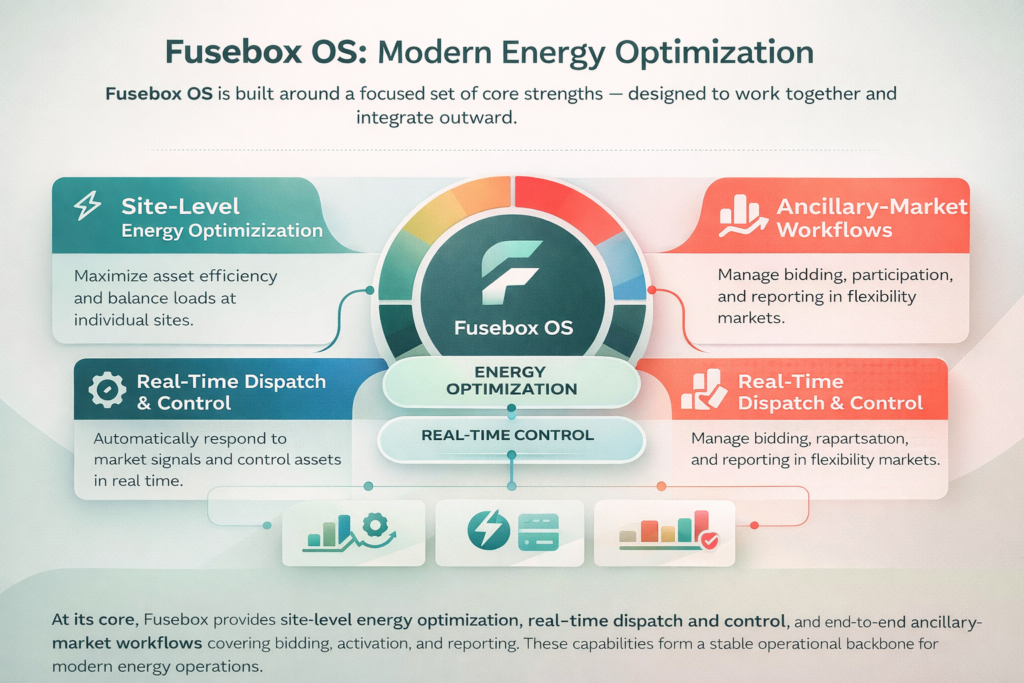

How it works

At its core, Fusebox provides site-level energy optimization, real-time dispatch and control, and end-to-end ancillary-market workflows covering bidding, activation, and reporting. These capabilities form a stable operational backbone for modern energy operations.

Keep your existing optimizer and trading/wholesale setup. Fusebox OS connects them to site control and TSO workflows, so the whole stack runs as one system. You keep flexibility in how you trade, optimize, and scale, while Fusebox ensures everything operates as one coherent system.

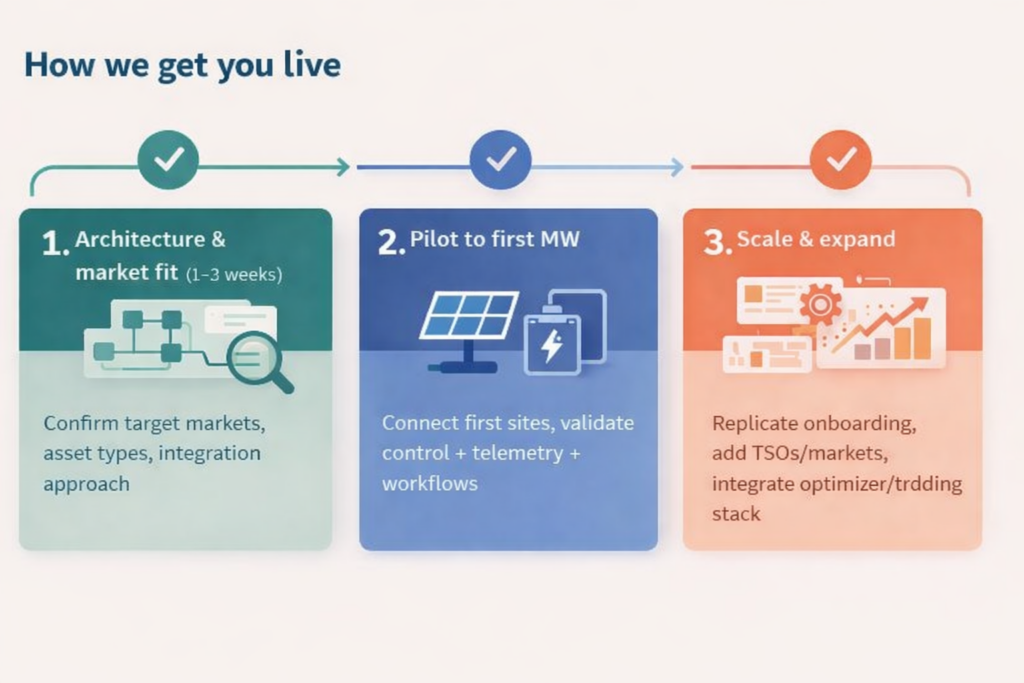

How we get you live

- Architecture & market fit (1-4 weeks): confirm target markets, asset types, integration approach

- Pilot to first MW: connect first sites, validate control + telemetry + workflows

- Scale & expand: replicate onboarding, add TSOs/markets, integrate optimizer/trading stack

Our Capabilities at a Glance

(Run assets through one OS)

(Turn portfolios into market capacity)

(Open by design, not a black box)